A call option is a futures contract that gives the buyer the right to buy an underlying asset, such as a stock, at a predetermined price by or on the expiration date specified in the contract. This type of option is useful for investors who wish to speculate on increasing the value of an asset without physically owning it. The main advantage of a call option is the possibility of profit while limiting risk, since the buyer is not obligated to purchase but only has the right to exercise it.

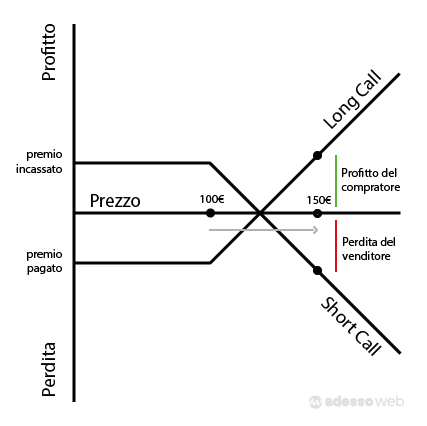

The call option is structured with a strike price, which is the predetermined price at which the buyer can purchase the underlying asset. The profitability of exercising a call option depends on the difference between the market price (spot price) and the strike price: if the market price exceeds the strike price, the option will be profitable and the buyer will be able to make a profit. If the price is below the strike price, the option will not be exercised, reducing the loss to only the cost of the premium paid to purchase the contract.

Contents

How the call option works

The call option gives the right to buy an asset at a set price, but does not obligate the holder to do so. This flexibility allows the investor to wait for market performance and consider whether or not to exercise the right to purchase. There are two types of call options: American call options and European call options.

- American call options allow the buyer to exercise the right at any time up to the expiration date, offering greater flexibility.

- European call options can be exercised only when the contract expires.

The designation “American” or “European” is not related to the market in which they are traded, but to the type of exercise. Generally, call options on individual stocks are of the American type, while those on market indices are often of the European type.

Example of a call option

To better understand how a call option works, let us take the example of a call option on the shares of a company, with a strike price of 60 €. This option entitles the buyer to buy one hundred shares of the company’s stock at a price of €60. If the market price of the shares rises to 63 €, the exercise of the option will produce a gain of 300 € (3 € profit per share) from which the premium paid to purchase it must be subtracted. This example highlights how a call option can generate profits for the investor when the market price exceeds the strike price.

The call option thus allows the investor to take advantage of positive market fluctuations to generate profit, but with a lower investment than buying the stock directly. However, if the stock price remains below the strike price, the option will expire worthless and the buyer will lose the premium paid for the contract.

Call options: in the money, out of the money and near the money

An option can be in three different situations depending on the relationship between the strike price and the market price of the underlying asset. If the market price of the asset is higher than the strike price, the option is in the money, that is, in a potential profit position for the buyer. In this case, exercising the option would result in an immediate gain.

When the market price is below the strike price, the option is out of the money and it is not worthwhile to exercise it, as this would result in a loss. On the other hand, if the market price is very close to the strike price, the option is near the money. In these situations, the investor must carefully monitor the market price to decide whether and when to exercise the call option.

The risks associated with call options

Call options offer attractive opportunities for gains, but they also present some risks. A person who buys a call option can lose the entire premium paid if the price of the underlying asset does not exceed the strike price by expiration. In addition, the call option has an expiration date, so the time available to achieve the gain is limited. Market volatility can play an important role: unexpected fluctuations can cause the option to expire out of the money, resulting in a loss of the initial investment.

To reduce risk, many investors combine call options with other hedging strategies, such as buying put options to protect against downside. Call options require a thorough understanding of the market and timing, especially for less experienced investors.

Writing call options

In addition to buying call options, investors can also write them, that is, sell them. Writing a call option means assuming the obligation to sell the underlying asset at the strike price if the buyer decides to exercise the option. In return for this obligation, the seller receives a premium, which is the immediate gain from writing the option.

Covered call option writing (covered call) is a popular strategy among long-term investors, in which the seller already owns the underlying asset and exploits the options to earn additional income. If the price rises above the strike price, the seller is obliged to sell the underlying asset, but can keep the premium. This strategy is ideal for those who have an equity portfolio and want to earn additional periodic income.

Writing uncovered call options and the associated risks

Writing uncovered call options is a high-risk strategy in which the investor sells a call option without owning the underlying asset. In this case, if the price of the underlying asset rises above the strike price, the seller will be forced to buy the asset at a higher price in order to sell it at the price set by the option, generating a potentially unlimited loss. Because of these risks, uncovered writing is reserved for very experienced investors who are willing to endure a high degree of volatility.

To protect the market and ensure stability, brokers require collateral (or initial margin) for writing uncovered call options. This hedge helps limit losses, although it does not completely eliminate the strategy’s high risk.

Conclusions

Call options are versatile financial instruments that allow investors to speculate on price rises, protect their portfolio, or generate additional income through option writing. However, these transactions require a good understanding of the market and associated risks. Both buying and writing call options offer opportunities for profit, but they must be used carefully to avoid significant losses. For experienced investors, call options represent a strategic component that, if well managed, can expand investment opportunities.

This article was created and reviewed by the author with the support of artificial intelligence tools. For more information, please refer to our T&Cs.

This article or page was originally written in Italian and translated English via deepl.com. If you notice a major error in the translation you can write to adessoweb.it@gmail.com to report it. Your contribution will be greatly appreciated

Giuseppe Fontana

I am a graduate in Sport and Sports Management and passionate about programming, finance and personal productivity, areas that I consider essential for anyone who wants to grow and improve. In my work I am involved in web marketing and e-commerce management, where I put to the test every day the skills I have developed over the years.