Options are derivative instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price, by or on a specific date. This characteristic makes them very versatile financial instruments, used for both speculative and hedging purposes.

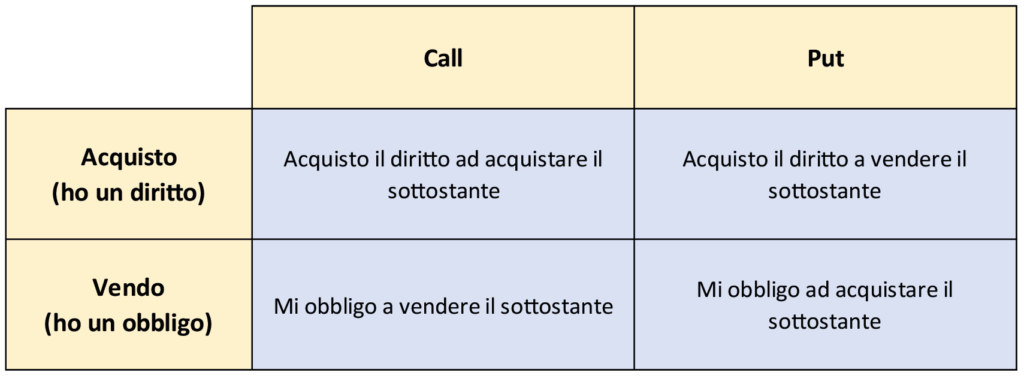

Options are based on an asymmetric contract: only the seller has an obligation to comply with the terms, while the buyer can freely decide whether or not to exercise the right acquired.

Contents

Key elements of options

Each option is defined by some specific elements:

- Underlying (or underlying): This is the element to which the option relates, which can be a stock, index, currency, commodity, or other type of asset. All options that share the same underlying belong to the same “series.”

- Faculty: There are two main types of options: the call, which gives the right to buy the underlying asset, and the put, which grants the right to sell it. Options of the same type are grouped into “classes.”

- Expiration: Options can be European or American. European options can be exercised only on the expiration date, while American options can be exercised at any time up to expiration.

- Strike price: This is the predetermined price at which the underlying can be bought or sold, depending on the type of option.

Types of positions in options

In the options market, investors can take four basic types of positions, each of which offers specific opportunities and risks.

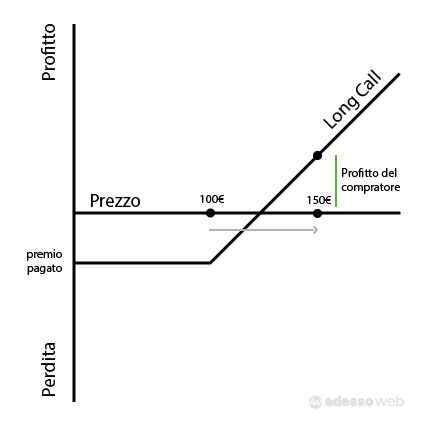

Long call : In this position, the holder of a call option has the right, but not the obligation, to buy the underlying asset at a predetermined price (the strike price) by a certain date. This type of position is commonly adopted by investors who anticipate an increase in the price of the underlying asset, allowing them to take advantage of a potential increase in value.

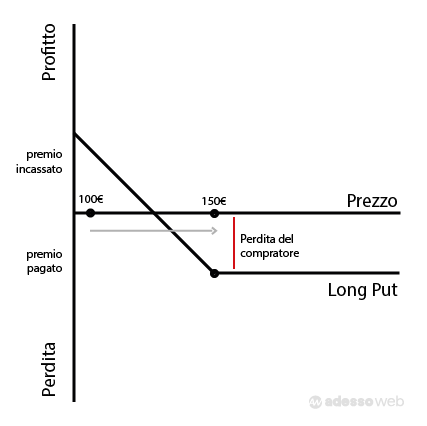

Long put: Similar to the long position on a call, the holder of a put option holds the right to sell the underlying asset at a predetermined price by a certain deadline. Investors who take this position often do so to protect themselves against a possible drop in the price of the underlying asset, allowing them to limit their losses.

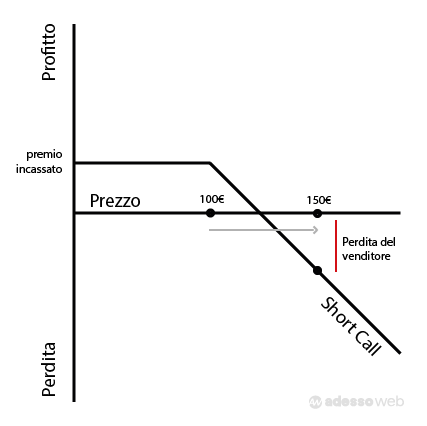

Short call: In this position, the seller of a call option is obligated to sell the underlying asset if the buyer decides to exercise his right. Investors who adopt this strategy generally hope that the price of the underlying will remain below the strike price, allowing them to collect the premium received without having to sell the asset.

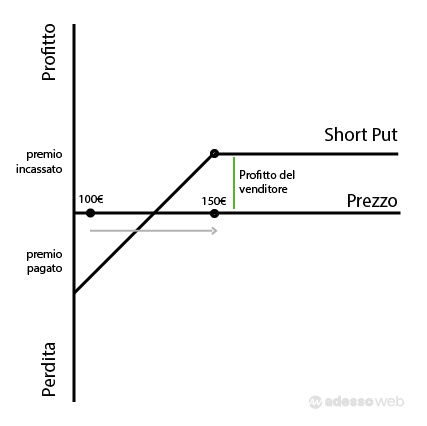

Short put: Here, the seller of a put option is obligated to buy the underlying asset if the buyer exercises his right to sell. Investors who opt for this position often do so in anticipation that the price of the underlying asset will remain stable or increase, allowing them to earn the premium without having to buy the asset.

The value of an option, whether call or put, can be positive or zero, but never negative. This is because the holder always has the freedom to decide whether to exercise the option or let it expire, thus maintaining some level of control over their investment.

Factors affecting the value of options

The value of an option is determined by several factors, each of which can significantly influence its valuation. The first key element is the price of the underlying asset : when the market price of the underlying asset approaches or exceeds the strike price, the value of the option increases. For example, in the case of a call option, the more the price of the underlying exceeds the strike price, the greater the value of the option. Another key factor is market volatility.

High volatility implies greater potential for changes in the price of the underlying asset, thus increasing the time value of the option as the probability of it becoming profitable increases.

The remaining life of the option also plays an important role: the longer the remaining life, the greater the time value, since the option has more time to enter “in the money” (that is, when it becomes profitable to exercise it). As time passes, however, the time value tends to decline in what is known as time decay: a few days from expiration, the time value is almost nil, leaving only the intrinsic value, that is, the difference between the price of the underlying asset and the strike price when the option is “in the money.” Interest rates are another factor: an increase in interest rates tends to increase the value of call options and decrease the value of put options, as investors may prefer to keep capital liquid or invested in less risky assets.

Purposes of options

Options are used by investors and financial traders to achieve three main purposes, each of which involves specific strategies and different levels of risk and return.

Speculation is one of the most common purposes: investors buy options with the intention of making a profit by taking advantage of changes in the price of the underlying asset. Specifically, if an investor anticipates that the price of a stock will rise, he or she might buy a call option to earn a profit from the difference between the purchase price and the selling price of the stock, without having to own the underlying stock. This strategy allows him to take advantage of even limited price movements by exploiting the leverage effect of options. Speculation with options can generate high returns, but it also has risks, as a wrong prediction can result in the loss of the entire premium paid.

Hedging is another crucial purpose for using options. Here, investors use options to protect a portfolio from potential losses due to unfavorable price changes. For example, an investor who owns stocks might purchase a put option to limit losses if the stock declines. If the stock price were to fall, the put option would allow the investor to sell at a predetermined price, thereby reducing the overall risk of the portfolio. This strategy is commonly used by institutional investors and fund managers to reduce the impact of market volatility and protect investment returns.

Finally,arbitrage is an advanced technique that exploits price discrepancies between different markets or financial instruments to make risk-free profits. Traders can buy options on one market and sell on another, or combine options with other financial instruments to take advantage of small price mismatches. For example, if an option is priced differently in two markets, a trader could buy where the price is lower and sell where the price is higher, making a profit without significant risk. Arbitrage requires significant speed of execution and in-depth knowledge of financial markets, and is generally practiced by financial institutions or professional traders with access to sophisticated trading systems.

Types of option contracts in Italy

In Italy, options are traded mainly on the IDEM market and include various types of contracts, such as:

- Mibo Options: Based on the FTSE MIB index, they are of the European type with monthly, quarterly, semi-annual and annual maturities.

- Weekly Mibo Options: They have weekly expiry dates.

- Stock Options: These can be of the U.S. or European type, with different exercise methods and maturities.

Practical example of using a call option

Imagine that an investor buys a European call option on the Alfa stock, with a strike price of €30 and expiration in one month, paying a premium of €2. At expiration, three situations can occur:

- Alpha security at €25: The investor does not exercise the option because it is not cheap; he loses only the initial premium of €2.

- Alpha security at €30: The investor is indifferent about exercising the option; he loses only the initial premium of €2.

- Alpha stock at €35: The investor exercises the option and buys the stock at €30, earning a net profit of €3 (35 – 30 – 2).

This example demonstrates how the value of an option can fluctuate and how the risk is limited to the loss of the initial premium, making options an attractive tool for managing risk in a portfolio.

Practical example of using a put option

Let us now consider a practical example to understand how a put option works . Suppose an investor purchases a European put option on the Beta security, with a strike price of €50 and a remaining term of one month, paying a premium of €3. At expiration, the following scenarios can occur:

- Beta security at €55: The investor decides not to exercise the option because the market price is higher than the strike price. It does not suit him to sell the security at €50 when he can sell it in the market at €55. In this case, the loss is limited to the premium initially paid of €3.

- Beta security at €50: The investor is indifferent whether to exercise the option or not, since the market price coincides with the strike price. Again, the loss is limited to the premium paid.

- Beta stock at €40: The investor exercises the put option, selling the stock at €50 when the market price has fallen to €40. In this scenario, he makes a net profit of €7 (50 – 40 – 3), considering the initial premium.

This example demonstrates how a put option can protect an investor from a decline in market prices by allowing him to sell at a set price, even if the value of the underlying asset declines. Put options are particularly useful for hedging and capital protection in bear market situations.

This article was created and reviewed by the author with the support of artificial intelligence tools. For more information, please refer to our T&Cs.

This article or page was originally written in Italian and translated English via deepl.com. If you notice a major error in the translation you can write to adessoweb.it@gmail.com to report it. Your contribution will be greatly appreciated

Giuseppe Fontana

I am a graduate in Sport and Sports Management and passionate about programming, finance and personal productivity, areas that I consider essential for anyone who wants to grow and improve. In my work I am involved in web marketing and e-commerce management, where I put to the test every day the skills I have developed over the years.