A put option is a futures contract that gives the buyer the right, but not the obligation, to sell an underlying asset at a set price by a specific date. This financial instrument offers a form of protection against a decline in the price of the underlying asset, allowing the holder to profit when the value of the asset falls below the agreed price (also called the strike price).

Put options are widely used to hedge the risks associated with fluctuating stock, futures and index prices, and are one of the most popular derivative instruments among investors.

Contents

- 1 Strike price and expiration of put options

- 2 Difference between American and European put options

- 3 Practical example: settlement of a put option

- 4 “In the money,” “out of the money” and “near the money” put options

- 5 Writing put options: benefits and risks

- 6 Example of risk in writing put options

- 7 Alternative strategies: buying shares with put options

Strike price and expiration of put options

The strike price, or strike price, is the set value at which the holder of a put option can sell the underlying asset. This value is set at the time the contract is purchased and is a key aspect in calculating the option’s return. Put options also have an expiration date , which means that they must be exercised within a limited period.

Typically, each option contract covers a standard lot of one hundred units of the underlying asset, for example, one hundred shares, and the expiration establishes the last date for exercising the put right.

Difference between American and European put options

Put options can be either American or European. American options allow the holder to exercise the put right at any time up to the expiration date, thus offering more flexibility. In contrast, European options allow the right to be exercised only when the contract expires.

This distinction has nothing to do with the trading region of the options, but simply refers to how the right is exercised. Put options on equities are generally of the American type, while those on indices are often European.

Practical example: settlement of a put option

To better understand how a put option works, let us take as an example a contract with a strike price of €30, relating to the shares of a company X. If the market price of the shares falls to 29 €, the option holder can buy the shares at 29 € and sell them at the agreed price of 30 €, thus realizing a profit of 100 € (equal to 1 € for each of the hundred shares included in the contract) minus the premium paid to buy the option.

“In the money,” “out of the money” and “near the money” put options

A put option is considered “in the money” if the price of the underlying asset is lower than the strike price, thus allowing the holder to make a profit.

If the asset price is higher than the strike price, the option has no economic value and is called “out of the money.” Finally, if the asset price and the strike price are very close, the option is considered “near the money, ” a situation in which the expediency of exercising the put right is uncertain.

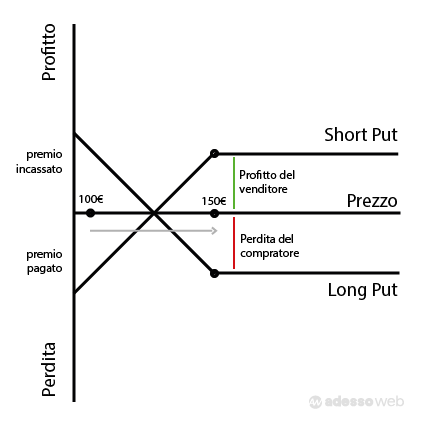

Writing put options: benefits and risks

Another way to trade put options is to write them, that is, to sell the put right to a third party. In this case, the seller receives a premium from the buyer and assumes the obligation to buy the underlying asset at the strike price, should the option holder decide to exercise it. The main benefit of writing put options is the premium received, which represents compensation for risk. However, if the price of the asset falls below the strike price, the seller may incur a significant loss, as he or she will be forced to buy at a higher price than the market value.

Example of risk in writing put options

Imagine a put option on X stock with a strike price of €30 and a premium of €2 per share. If the share price remains above €30 until expiration, the seller retains the premium in full. However, if the price falls below €30, the seller must buy the shares at the agreed price, incurring a loss. For example, if the price falls to 29 €, the net loss is reduced due to the premium, but if the price continues to fall, the loss may increase considerably, reaching a maximum when the share price reaches zero.

Writing put options can be an alternative strategy to acquire an underlying asset at a lower price. An investor who expects a long-term increase in value can sell put options instead of immediately buying the stock. As long as the share price does not fall below the strike price, the premium received becomes a net profit. Otherwise, the investor gets the stock at the strike price, which may be more profitable than a direct purchase, minimizing losses if the price falls.

In summary, the put option is a versatile tool for risk management in financial trading, offering different possibilities for profit and hedging depending on the strategy adopted.

This article was created and reviewed by the author with the support of artificial intelligence tools. For more information, please refer to our T&Cs.

This article or page was originally written in Italian and translated English via deepl.com. If you notice a major error in the translation you can write to adessoweb.it@gmail.com to report it. Your contribution will be greatly appreciated

Giuseppe Fontana

I am a graduate in Sport and Sports Management and passionate about programming, finance and personal productivity, areas that I consider essential for anyone who wants to grow and improve. In my work I am involved in web marketing and e-commerce management, where I put to the test every day the skills I have developed over the years.